This post is part of a 3 part series that uses a spreadsheet to answer the following question: can you retire? The 3 parts are as follows:

Introduction

Before I start, this post is not about investment advice. There are a lot of resources out in the web for that, and investments is something I cannot claim to be an expert in. Basically, do your own research!

Instead, the focus on this post will be to elaborate on how we can use a spreadsheet to drive your retirement planning goals, either by helping you to plan around your sources of income, or to help you identify shortfalls where some extra income might be useful.

Because there are so many ways to look at the numbers, this post will consist more of tips and tricks that aim to help you develop alternative scenarios when it comes to looking at your income streams. But first, let’s have a look at the tool we will use to optimise your income.

The Spreadsheet

This spreadsheet looks like the one from Part 2, with an added section: Others. This is where all cash-generating activities come in. Here we specify the inflows in cash from each type of cash-generating activity, but importantly also the outflows in capital we use to generate these cash inflows.

Quick disclaimer: Please treat the information in this article as only one of the many sources you can use, and do your own further research in order to make an informed decision.

Cash outflows?

It is oftentimes said that you need to spend money to make money. This is especially true in a society dominated by capitalism – as is the case in many parts of the world today. These kinds of cash outflows are called investments, and is used in the realm of investing.

Investing might seem extremely daunting to many people, but it is as simple as the following: Spending money now, to get more money in the future. A successful investment gives you more money when that future date arrives; an unsuccessful one less money, or even takes money away from you.

Let’s use a familiar example to examine this: buying a pair of headphones.

When making a purchase decision for headphones, the tradeoff is usually in terms of price and quality. Cheaper headphones are generally of a lower quality, and last for a shorter period of time. The opposite is (theoretically) true of more expensive headphones. The below spreadsheet demonstrates the differences in cost of each kind of product, as well as how much one would eventually spend on headphones, given an expected product lifetime. Go ahead and play around with the spreadsheet.

From the above we can see that based on the assumptions above, in the long-run we actually save more than 300 bucks investing in the better quality headphones. This is the idea behind investing: making a bigger upfront expenditure, for future benefits that hopefully outweigh the initial cost.

This is the crux behind investing. Except that investing usually involves spending an initial amount (what finance peeps call the principal), in (theoretically) cash-generating assets.

Adding investments to the spreadsheet

How do we make use of the Retirement Planner spreadsheet to judge whether investments are feasible or not?

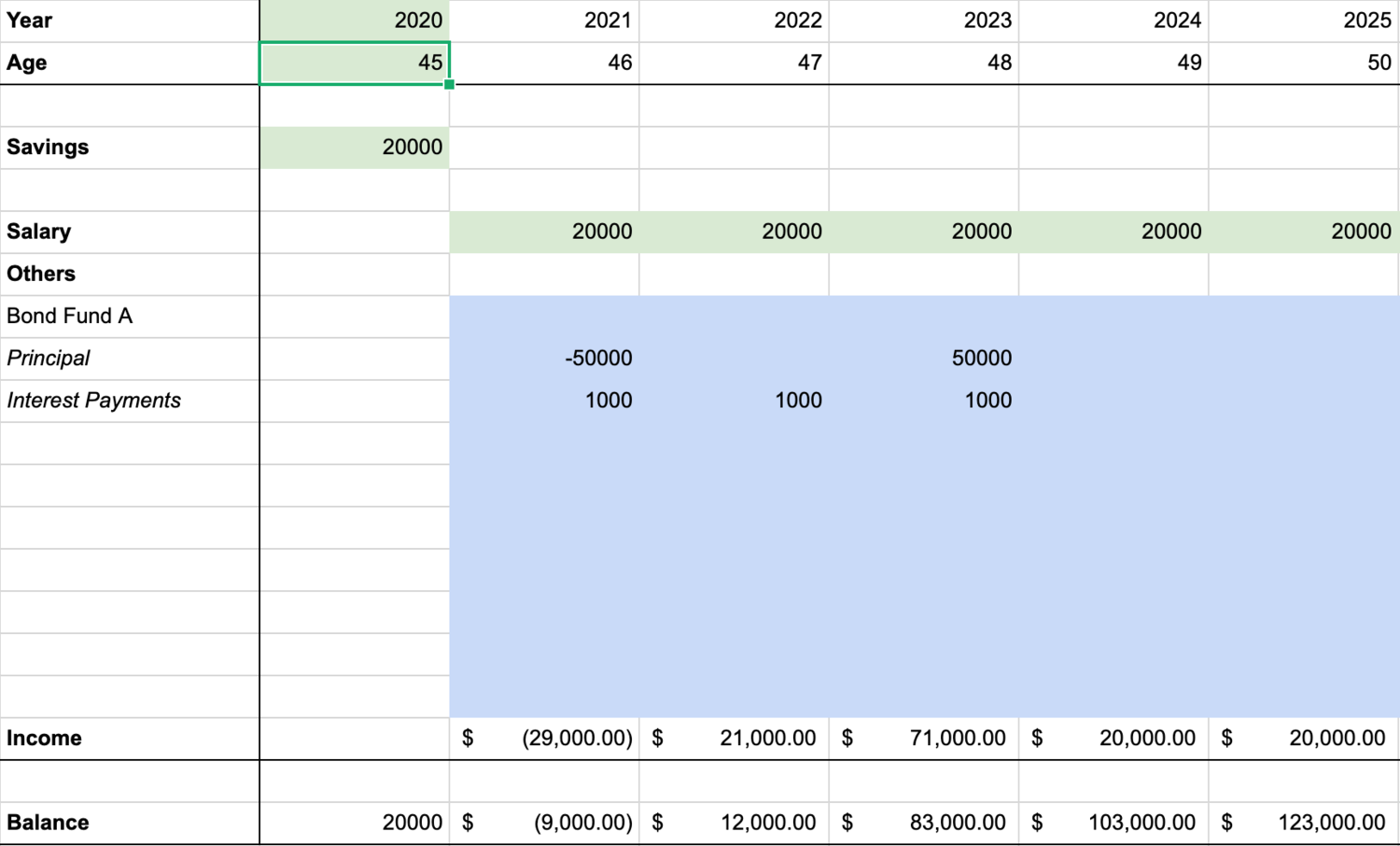

Assuming we want to invest in a Bond Fund A that has a $50K initial investment, with a simple interest of 2% every year, until maturity 3 years later. This represents a $50K cash outflow at the first year, then $1K inflows for 3 years before final repayment of $50K. We can represent the above in the spreadsheet as follows:

Simple as that. But notice what this does to our final balance in 2021. We find ourselves below 0! Investment risk aside, we know immediately that this investment does not work for us, because we would not have enough money to survive in 2021.

Some things we can do to avoid this shortfall would be to delay the investment til we have enough funds prepared to make it, or look for other investments that don’t cost that much upfront.

Other angles of approach

Investments is not the only way we can look at income. Here are some other approaches that could be useful as well.

Salary is a variable stream

An important thing to realise about your salary income is that you choose how long you want to work for. Or another way to phrase it: why work for longer in a job you might not like, if you do not have to?

Let’s take the following scenario as an example.

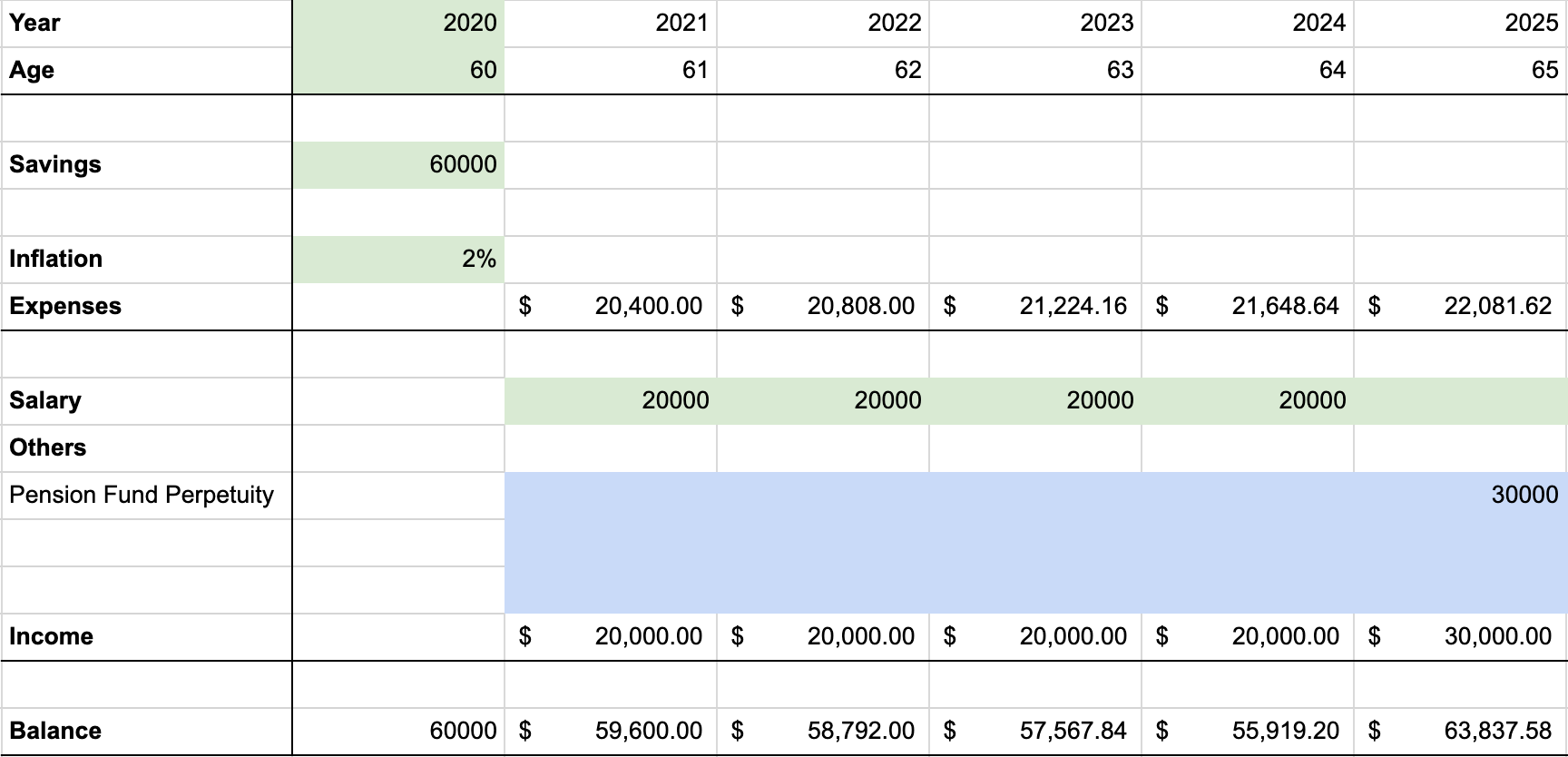

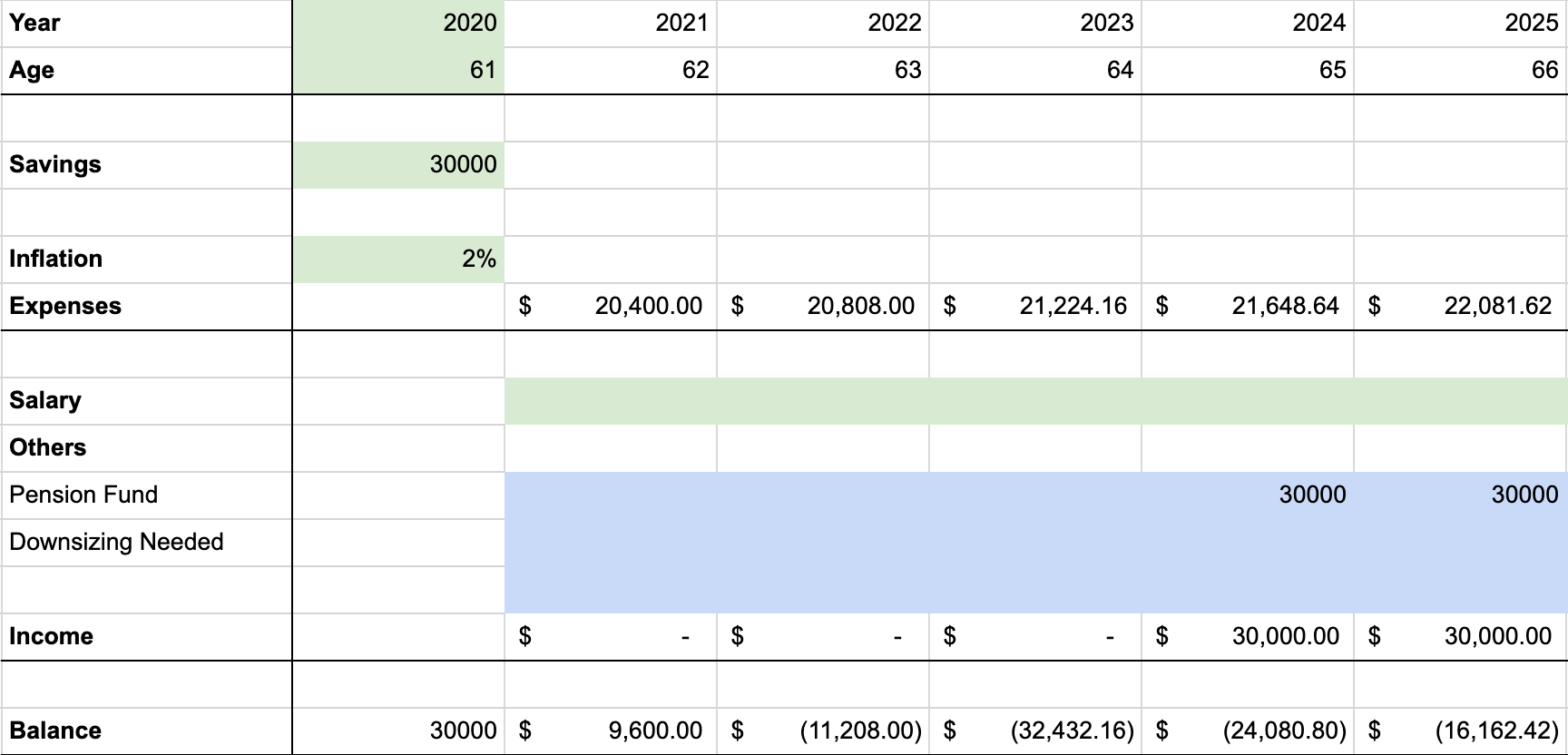

You are expecting your pension fund to start kicking in when you are 65. In the meantime, you have an ongoing expenses of $20,000, adjusted each year for inflation. Because your pension fund only kicks in at 65, you decide, “Hey, I just have to stay in my job for the next 4 years!”

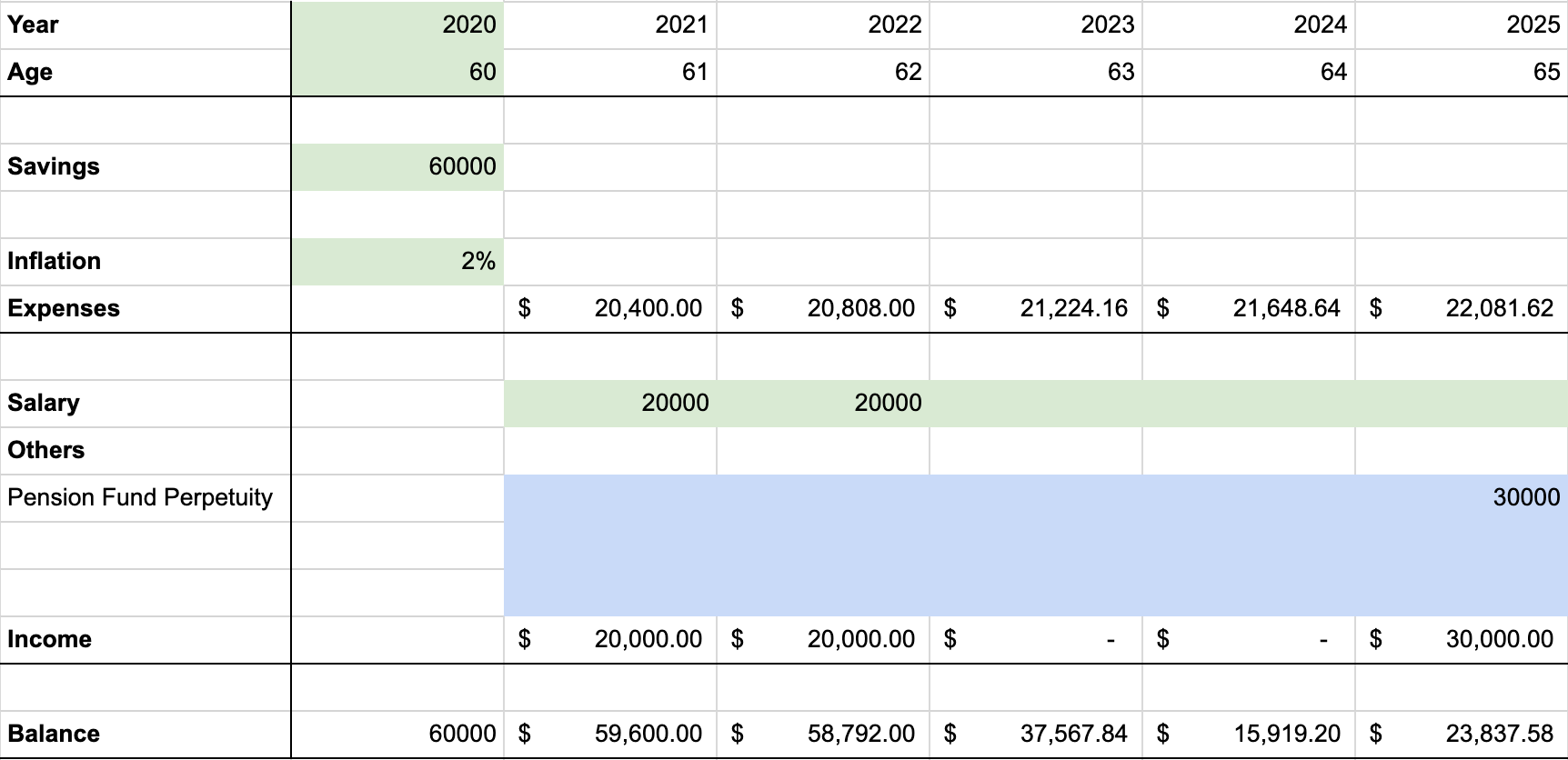

But wait! What happens if you decide you want to retire earlier, before your pension fund even kicks in? Removing 2 years of salary, you can see that in the Balance you are most definitely still afloat:

With this simulation, you might have just shaved off 2 years of working at a stress-inducing, soul-sucking job.

Salary increments

Running the calculations can help you discover shortfalls in income which can impact your financial survival, which can provide you with good impetus to act.

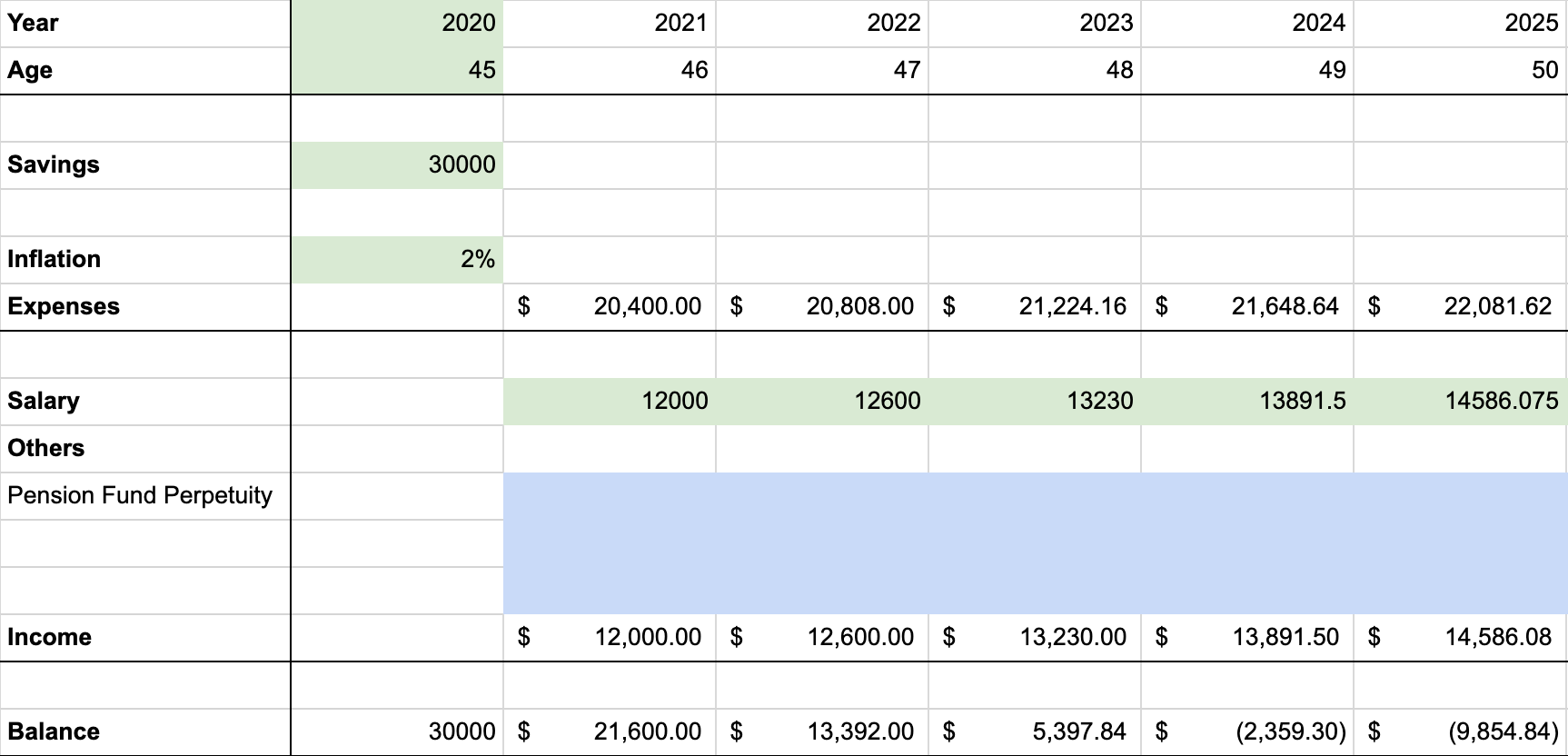

As an example, let’s assume that you are in an okay job paying $1,500 a month, but that guarantees (as far as guarantees can be given) a 5% increment every year on top of your original salary. You decide that it is okay for you – because it gives you the opportunity to not bother about the rat race while you are pursuing your passion of training octopuses to unscrew bottle caps. You have some savings in the bank, and together with the increments, this will guarantee that you will never hit rock bottom. Right?

Let’s re-examine those assumptions, by building them into your spreadsheet:

We can see that in fact, after 4 years have passed, your finances indeed will dip under 0! This can act as a warning sign, giving you some lead time to figure out a way to avoid the drop.

Houses can be a part of your plan

And by this I don’t mean just the straightforward approach of renting. I mean that if push comes to shove, downsizing can also be an option, to provide a temporary boost.

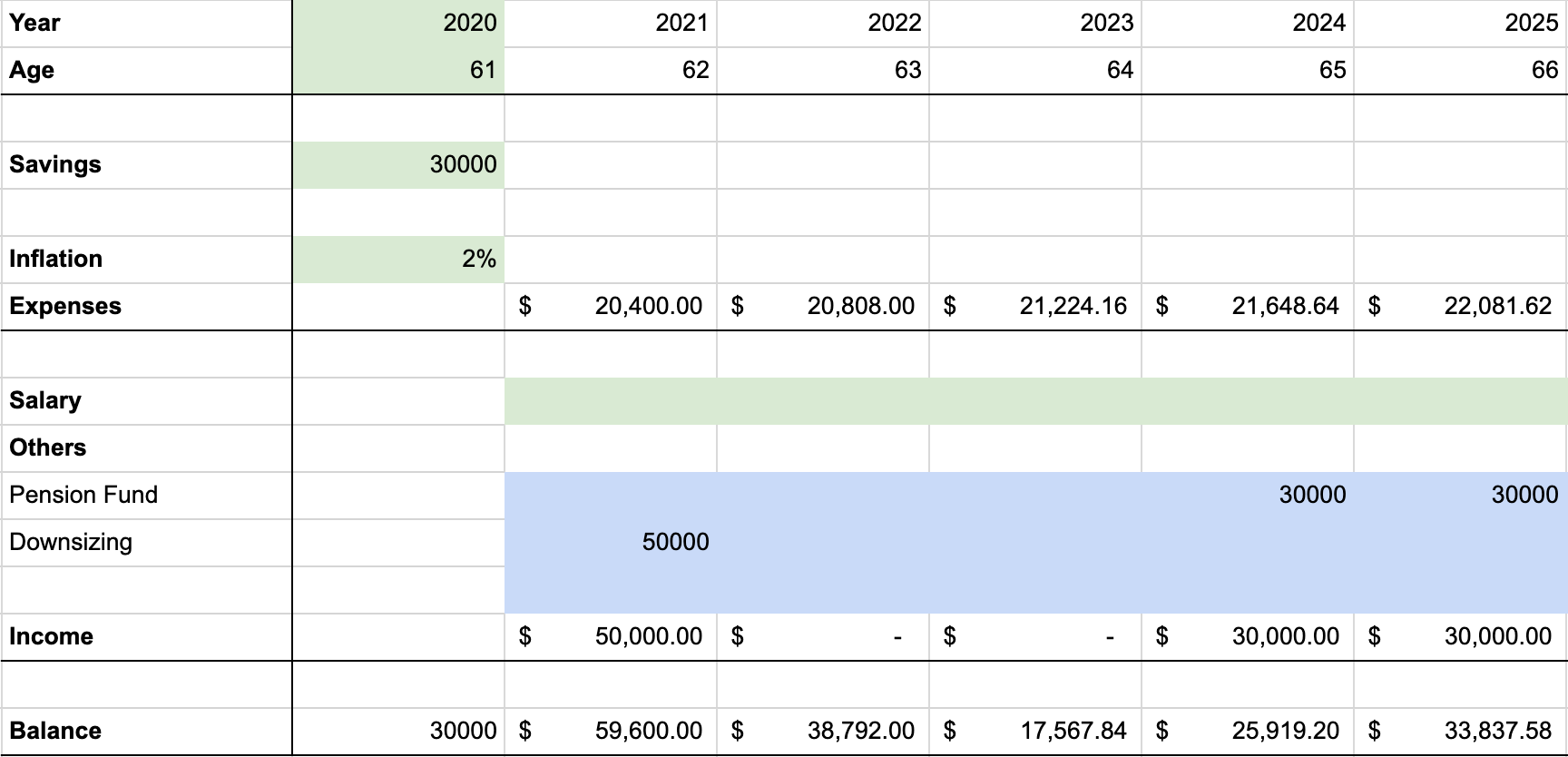

Let’s look at a scenario where you know that your pension funds start kicking in only when you are 65. That’s about 3 years away. In the meantime you would rather leave your job and retire earlier.

What can we do then?

Do you have a house? What about considering the option of downsizing?

Based on the above diagram you know that you would need about $33k in order to offset the shortfall in funds that you will start experiencing in about 1 year’s time. This number can be a starting point, telling you how much exactly you need to get out of your downsizing effort.

Plugging in about $50k into our plan, we can see that we are left with a relatively healthy $17k buffer as the lowest point in our finances. So in this case $50k can be a useful target in our downsizing efforts.

Conclusion

In this 3rd part, we have gone through some ways we can use our Retirement Planner spreadsheet to tune our income streams, and explored different ways it can be used to help us plan for our financial future.

Hope this helps!